Trend Handling Protocols for Distilling Time Series Data

Trend Handling Protocols for Distilling Time Series Data.

USPTO Track 1 Patent Application / patent pending

Dr. Asoka Korale

Trend Handling Protocols for Distilling Time Series Data.

USPTO Track 1 Patent Application / patent pending

Dr. Asoka Korale

New Technology

Dear Friends,

I look for your support for a patent I applied from the USA, “Trend handling protocols for distilling time series data”

Thank you.

Dr. Asoka Korale

Colombo,

Sri Lanka

USPTO Track 1 Patent Application / patent pending

The AEON Law firm in Seattle, Washington,

Strategic advisor Adam Phillip

Patent attorney Jonathan Olson

Dear Friends,

I look for your support to introduce me to investors and venture capital for a patent I applied from the USA, “Trend handling protocols for distilling time series data”, a Track One patent application, patent pending. I am happy to work with them to contribute to their projects, products and requirements.

The AEON Law firm in Seattle, Washington, led by Adam Philipp is my strategic advisor and Jonathan Olson is my patent attorney.

It secures IP rights to a new model of time series, method of time series analysis and statistical learning and a new technology in telecommunications and the stock market.

Time series trends provide information about risk and uncertainty in stock prices to allocate capital and diversify risk. Telecommunications traffic modeling to manage congestion levels is another application.

Thank you.

Dr. Asoka Korale

Colombo,

Sri Lanka

Introduction

“Trend handling protocols for distilling time series data” ,

USPTO Track 1, Patent application

• Users interact with market data to select and compare time series trends.

• Model of trend, assign score depending on risk, return, and uncertainty.

• Computer program and data base. Analyze historical prices. Learn patterns in prices. Predict risk and return.

• Statistical learning method. Signal risk in trends.

“Trend handling protocols for distilling time series data” ,

USPTO Track 1, Patent application

• Users interact with market data to select and compare time series trends.

• Model of trend, assign score depending on risk, return, and uncertainty.

• Computer program and data base. Analyze historical prices. Learn patterns in prices. Predict risk and return.

• Statistical learning method. Signal risk in trends.

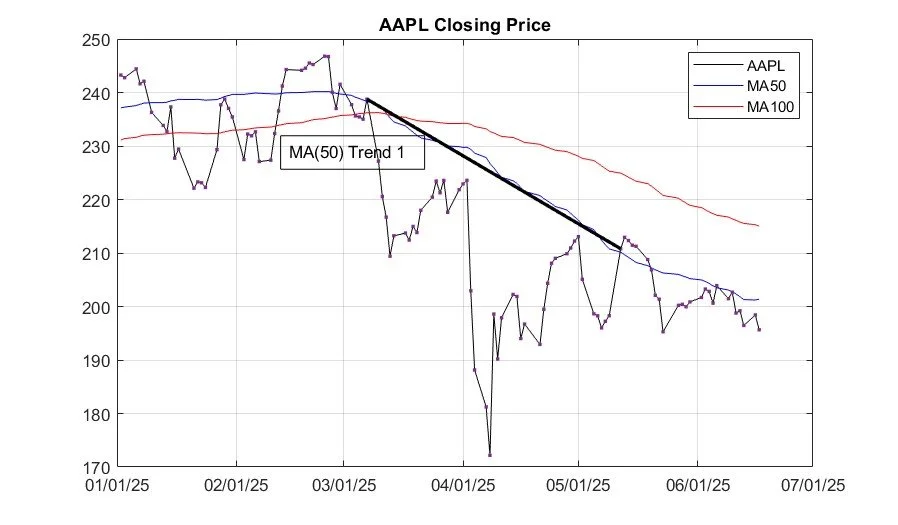

Moving average trend and trend line

Trend line (3/07/2025 - 5/12/2025) from MA(50).

Simple moving average 50 days MA(50) and 100 days MA(100).

Time period 1/2/2025 - 6/17/2025.

Trend line (3/07/2025 - 5/12/2025) from MA(50).

Simple moving average 50 days MA(50) and 100 days MA(100).

Time period 1/2/2025 - 6/17/2025

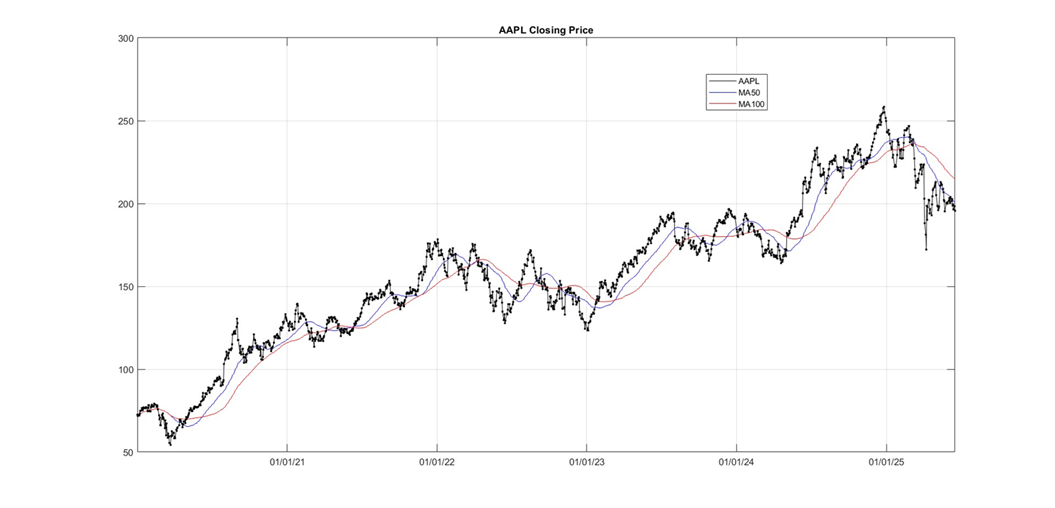

Stock and moving average trend comparison

6/17/2025: AAPL 195.64, MA(50) 201.35, MA(100) 215.00

Simple moving average 50 days and 100 days.

Time period 1/2/2020 - 6/17/2025.

6/17/2025: AAPL 195.64, MA(50) 201.35, MA(100) 215.00

Simple moving average 50 days and 100 days.

Time period 1/2/2020 - 6/17/2025.

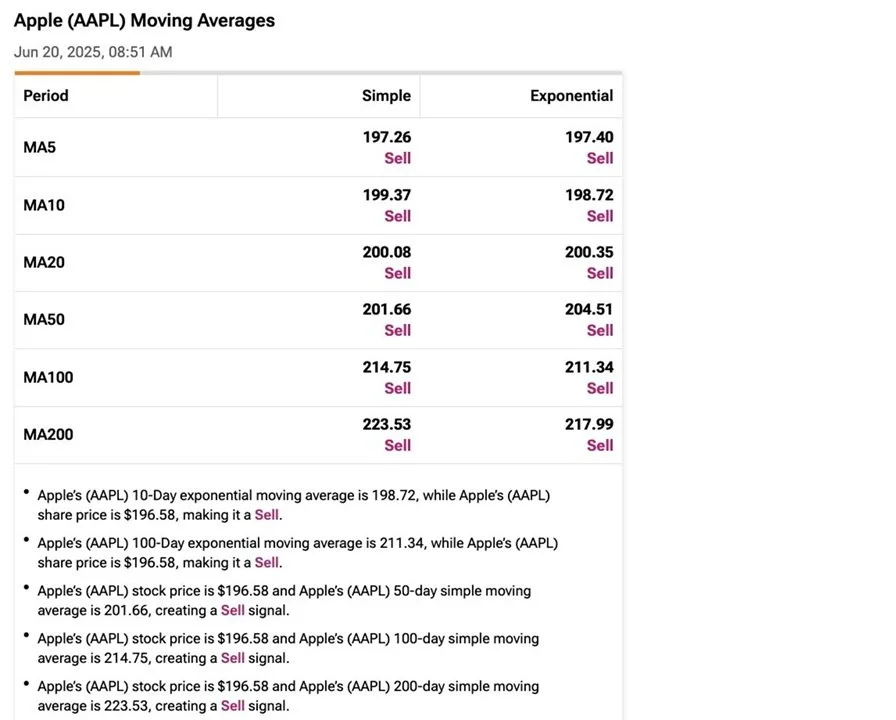

Moving average trend (Stock Charts.com)

Compare series with 50 and 100 day simple moving average.

Time period 1/2/2020 - 6/17/2025.

Compare series with 50 and 100 day simple moving average.

Time period 1/2/2020 - 6/17/2025.

Apple (AAPL) Moving Averages

Moving average. Momentum. Signal.

Why Investors Should Reconsider Buying the Dip on Apple Stock (AAPL), Bernard Zambonin, Jun 24, 2025, 07:00 AM, https://lnkd.in/gRZhduQy

Moving average. Momentum. Signal.

Why Investors Should Reconsider Buying the Dip on Apple Stock (AAPL), Bernard Zambonin, Jun 24, 2025, 07:00 AM, https://lnkd.in/gRZhduQy

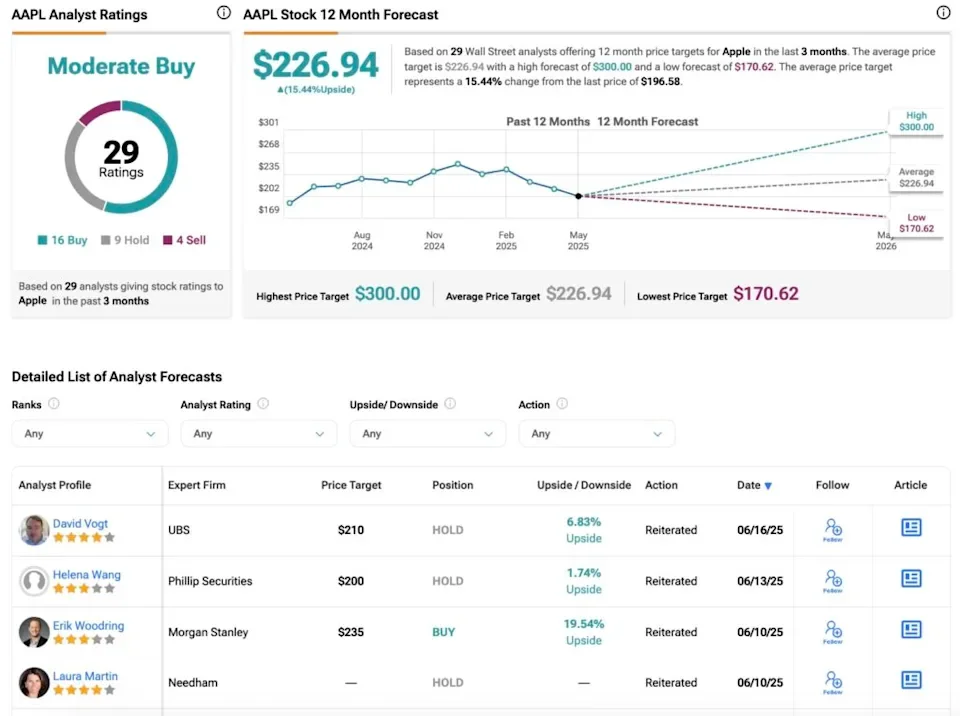

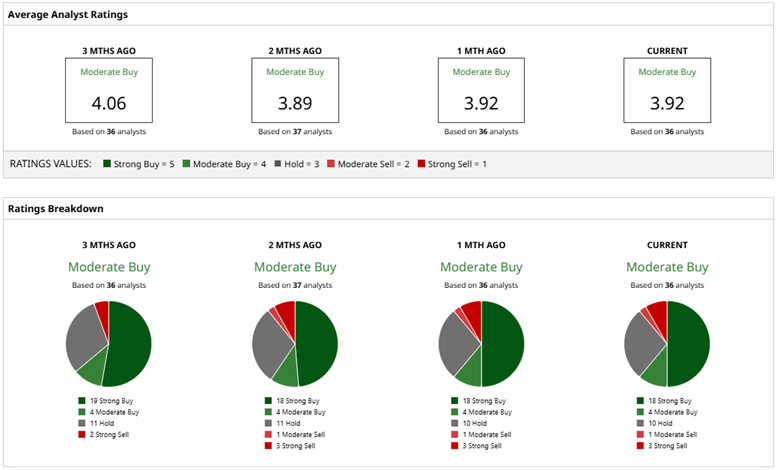

AAPL Analyst ratings

Historical Trends. Forecast price target.

Why Investors Should Reconsider Buying the Dip on Apple Stock (AAPL) Bernard Zambonin, Jun 24, 2025, 07:00 AM, https://lnkd.in/gRZhduQy

Historical Trends. Forecast price target.

Why Investors Should Reconsider Buying the Dip on Apple Stock (AAPL) Bernard Zambonin, Jun 24, 2025, 07:00 AM, https://lnkd.in/gRZhduQy

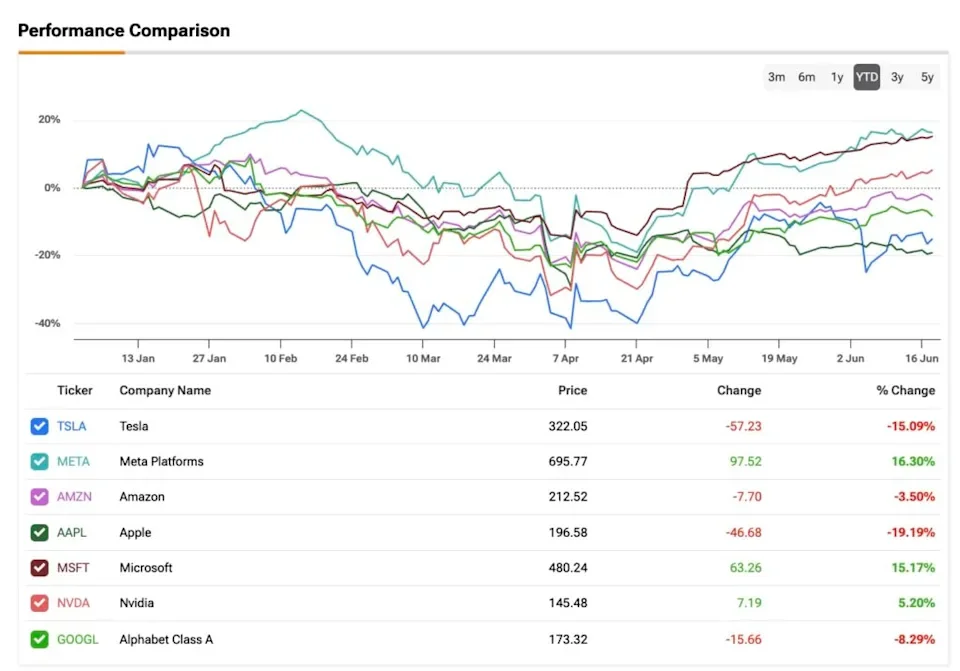

Performance comparison

Compare time series. Stock trends.

Why Investors Should Reconsider Buying the Dip on Apple Stock (AAPL)

Bernard Zambonin, Jun 24, 2025, 07:00 AM, https://lnkd.in/gRZhduQy

Compare time series. Stock trends.

Why Investors Should Reconsider Buying the Dip on Apple Stock (AAPL)

Bernard Zambonin, Jun 24, 2025, 07:00 AM, https://lnkd.in/gRZhduQy

Analyst forecast and risk measure

Why Investors Should Reconsider Buying the Dip on Apple Stock (AAPL)

Bernard Zambonin, Jun 24, 2025, 07:00 AM, https://lnkd.in/gRZhduQy

Analysis. Graphics.

Performance Comparison. Risk Distribution. Gross Margin by Type.

Apple (AAPL) Moving Averages. AAPL Stock 12 Month Forecast. Detailed List of Analyst Forecasts.

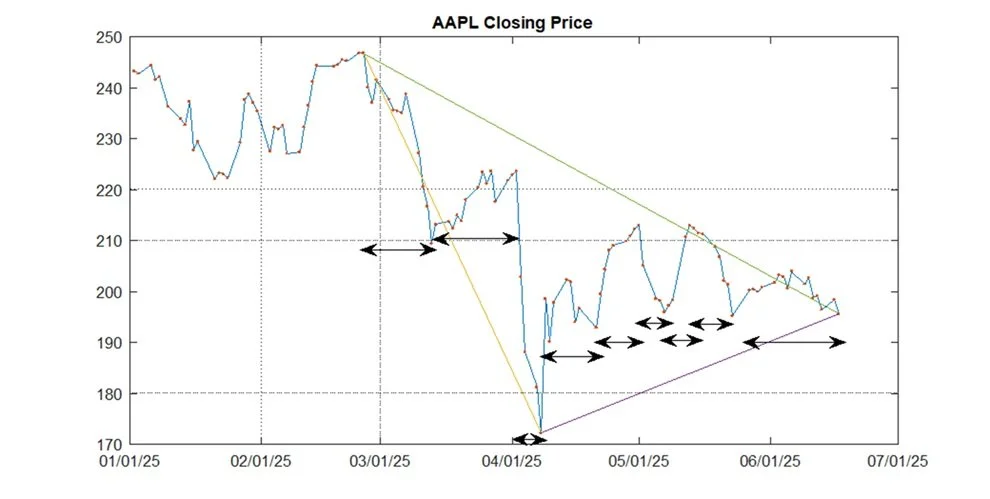

Trend line: Risk trends, Return trends

Slide 12. Trend line: Risk trends, Return trends

Trend line. Time periods.

Trend 1: 2/25/2025 - 6/17/2025

Trend 2: 2/25/2025 - 4/08/2025

Trend 3: 4/08/2025 - 6/17/2025

Trend line: Risk, Return: (slopes, time intervals, time periods, peaks, troughs, levels, runs, ...)

Trend line. Time periods.

Trend 1: 2/25/2025 - 6/17/2025

Trend 2: 2/25/2025 - 4/08/2025

Trend 3: 4/08/2025 - 6/17/2025

Trend line: Risk, Return: (slopes, time intervals, time periods, peaks, troughs, levels, runs, ...)

Intra-day volatility (Stock Charts.com)

Slide 13. Intra-day volatility (Stock Charts.com)

Intra-day volatility.

Time period. 01/01/2025; 06/17/2025.

Intra-day volatility.

Time period. 01/01/2025; 06/17/2025.

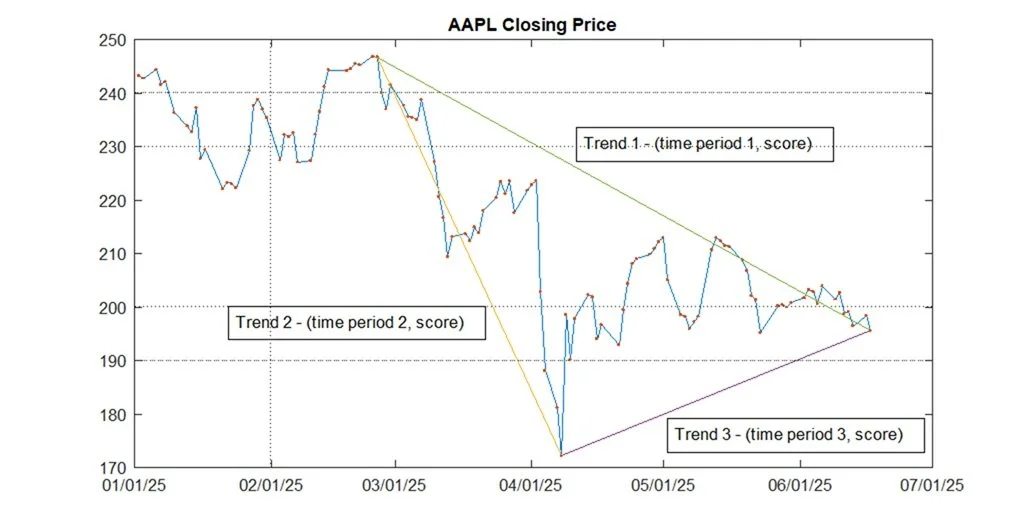

Trend line fitting score

Slide 14. Trend line fitting score

Trend line fitting (time period, score)

2/25/2025; 4/08/2025; 6/17/2025Risk / Return Optimization

Trend line fitting (time period, score)

2/25/2025; 4/08/2025; 6/17/2025Risk / Return Optimization

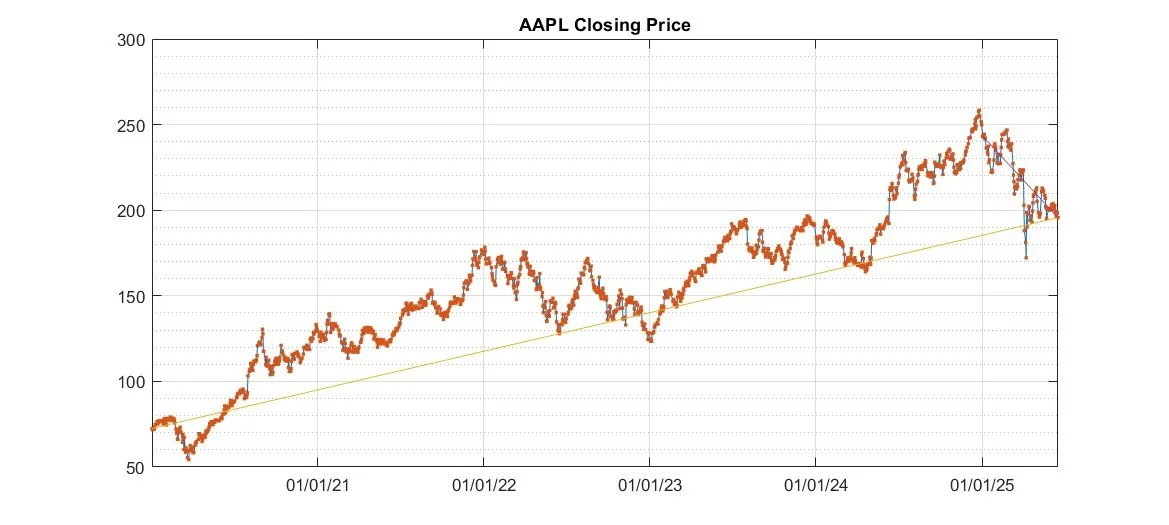

Market news and stock trends

Slide 15. Market news and stock trends

Market news and stock trends.

Trend 1: 1/02/2020 - 06/17/2025, 72.53 - 195.64

Trend 2: 1/02/2025 - 06/17/2025, 243.26 - 195.64

Long and short term.

Average variation

Market news and stock trends.

Trend 1: 1/02/2020 - 06/17/2025, 72.53 - 195.64

Trend 2: 1/02/2025 - 06/17/2025, 243.26 - 195.64Long and short term.

Average variation

Analyst risks

Slide 16. Analyst risks

Should You Buy the Dip in Apple Stock in April 2025? Ruchi Gupta - Barchart - Sat Apr 5, 6:00AM CDT

Should You Buy the Dip in Apple Stock in April 2025?

Ruchi Gupta - Barchart - Sat Apr 5, 6:00AM CDT

Analyst risks - 2

Slide 16. Analyst risks

Should You Buy the Dip in Apple Stock in April 2025? Ruchi Gupta - Barchart - Sat Apr 5, 6:00AM CDT

Should You Buy the Dip in Apple Stock in April 2025?

Ruchi Gupta - Barchart - Sat Apr 5, 6:00AM CDT

Trend lines, risk and return, time periods

slide 17. Trend lines, risk and return, time periods

Long and short term.

Trend line: Time periods:

Trend 1: 05/13/2016 - 01/07/2019

Trend 2: 01/07/2019 - 03/23/2020

Trend 3: 03/23/2020 - 01/05/2023

Trend 4: 01/05/2023 - 04/19/2024

Trend 5: 04/19/2024 - 06/13/2025

Trend lines, time periods,

measure risk and return.

Long and short term.

Trend line: Time periods:

Trend 1: 05/13/2016 - 01/07/2019

Trend 2: 01/07/2019 - 03/23/2020

Trend 3: 03/23/2020 - 01/05/2023

Trend 4: 01/05/2023 - 04/19/2024

Trend 5: 04/19/2024 - 06/13/2025Trend lines, time periods, measure risk and return.

Long and short term trends (Stock Charts.com)

Slide 18.

Long and short term trends (Stock Charts.com)

Trend line risk and return

Slide 19

Profile uncertainty in the time series

Profile uncertainty in the time series

Compare trends in the time series (Stock Charts.com)

slide 20

Compare trends in the time series (Stock Charts.com)